In the dynamic landscape of finance, retail banking emerges as a cornerstone, connecting financial institutions with individuals. This article explores the multifaceted dimensions of retail banking Market, from its diverse services and distinctive sector, to the expansive market size, ongoing research, and the exciting prospects shaping the future.

- Retail Banking Service: Tailoring Financial Experiences

At its core, retail banking prioritizes providing tailored financial services to individual consumers. These services span from fundamental savings and checking accounts to complex offerings like mortgage loans and personal lines of credit. The emphasis is on creating a seamless and personalized experience for customers at every financial touchpoint.

- Retail Banking Sector: Navigating the Financial Landscape

The retail banking sector constitutes the segment of the financial industry dedicated to serving individual consumers. Unlike investment or corporate banking, retail banking focuses on the day-to-day financial needs of people. It includes branches, online platforms, and ATMs, all working together to deliver accessible financial solutions.

- Retail Banking Market Size: Dimensions of Growth

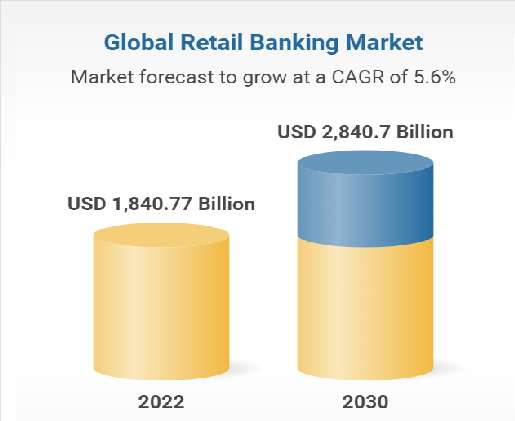

Understanding the Retail Banking Market Size involves examining the monetary value of transactions, assets under management, and the overall economic impact. As of [current year], the global retail banking market size stands at [market size], reflecting the significant role this sector plays in the broader financial ecosystem.

- Retail Banking Research: Insights Shaping the Future

Continuous research is vital to adapting retail banking services to evolving consumer needs and technological advancements. Retail banking research explores topics such as customer behavior, emerging technologies, and regulatory changes. This ongoing investigation is crucial for banks to stay competitive and innovative.

- Future of Retail Banking: Anticipating Trends and Innovations

As we peer into the future of retail banking, several trends and innovations come into focus. The integration of artificial intelligence, the rise of mobile banking, and the emphasis on sustainable and ethical banking practices are anticipated to shape the future landscape of retail banking.

In Conclusion

In conclusion, retail banking stands as a dynamic force in the financial realm, offering personalized services, steering a dedicated sector, and contributing significantly to the global economy. With ongoing research and an eye on future trends, retail banking is poised for continued evolution and innovation, ensuring it remains a cornerstone of individual finance.