Stricter oversight reforms Indonesian P2P lending for protection. Flourishing Fintech market in Indonesia creates business opportunities, emerging as Southeast Asia’s Fintech powerhouse with 785 businesses.

Introduction

The oversight gap in the P2P lending industry has sparked a wave of stricter government actions in Indonesia. However, this shift has inadvertently paved the way for a surge in new Fintech Startups, breathing fresh life into the P2P lending market. With increased regulations and accountability measures in place, these start-ups are entering the arena with innovative solutions and enhanced security measures. This revitalization of the sector not only ensures better protection for borrowers and investors but also offers promising business opportunities for those ready to capitalize on the evolving Indonesian Fintech landscape.

Storyline

- Stricter Oversight Fuels Reforms in Indonesian P2P Lending Sector

- Indonesia’s Financial Services Authority takes action to tackle illicit lenders, introducing new regulations and capital requirements to safeguard borrowers and investors.

- Indonesian Fintech Market Flourishes, Creating Lucrative Business Opportunities

- Collaboration events and updated regulations propel the growth of Fintech Startups, driving investment in Indonesia’s digital economy and promoting financial inclusion.

- Indonesia Emerges as Southeast Asia’s Fintech Powerhouse

- With 785 Fintech businesses and significant investment, Indonesia solidifies its position as a major Fintech hub, attracting attention and funding in the region.

- Increased Oversight in Indonesia’s P2P Lending Sector

Other Challenges In Indonesia’s P2P lending market

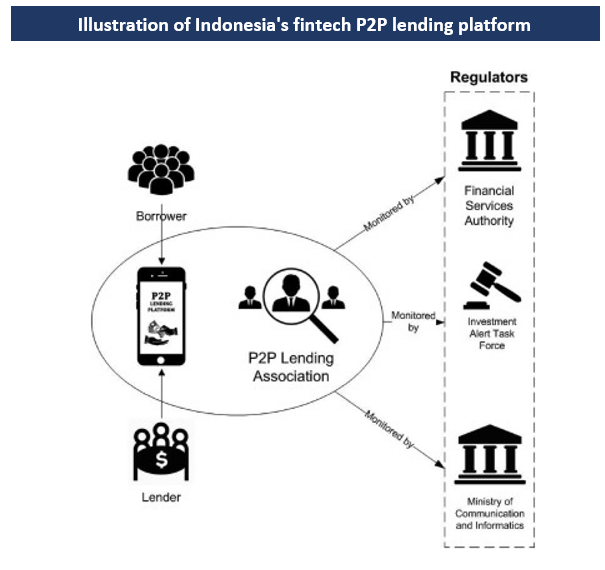

Peer-to-peer (P2P) lending has rapidly expanded in Indonesia, raising worries about the acquisition of personal information from borrowers and an increase in illicit internet lenders in Indonesia, creating a disruption in P2P lending market. In response, Indonesia’s Financial Services Authority, or OJK, released OJK Regulation No. 10/POJK.05/2022 (POJK 10/2022) in July 2022. POJK 10/2022 aims to take down unethical and financially unsound Fintech players by introducing new capital requirements, reworking the licencing regime, and introducing minimum equity requirements.

- “Unlocking the Goldmine: Indonesian Fintech Market Presents Lucrative Business Prospects!”

To learn more about this report Download a Free Sample Report

The Singapore Fintech Association and Enterprise Singapore, together with Synthesis Communication Indonesia, organized a business seminar and networking event entitled “Fintech: Fostering Cross Border Collaboration” on August 24, 2022, in Jakarta to further dissect investment opportunities in Indonesia’s digital economy. The event was attended by 18 SFA members and several Indonesian companies from various sub-sectors of the digital economy as well as representatives of many Fintech companies who are members of the Indonesia Fintech Association (AFTECH).

The association also called for more initiatives to boost financial inclusion, including working with regional or provincial banks for working capital lending disbursement. Currently, only around 7 percent of the total regional bank loans are being disbursed properly.

Having said that, there is still around 92 percent idle money in provincial banks that can be channelled into productive credit by collaborating with crowdfunding Fintech.

Moreover, of late, the government has continued to update regulations to encourage greater investment in the Fintech space.

3.Top Fintechs in Indonesia with the most Funding in 2022

Visit this Link: – Request for custom report

Peer-to-Peer Lending’s Function in Fintech

Currently, P2P lending is in its growing phase and has introduced a new set of investment opportunities for all stakeholders in the Fintech industry. The next-gen investors are now shifting from traditional means to explicit P2P lending apps for processing loans. The largest economy in Southeast Asia, Indonesia, has become one of the main Fintech centres in recent years.

As of the end of 2021, Indonesia has 785 Fintech businesses, making it Southeast Asia’s second-largest hub for Fintech Startups. The scope and influence these businesses have on the Southeast Asian Fintech ecosystem is demonstrated by the fact that they have obtained 26% of all Fintech financing in the region, second only to Singapore (44%).

Conclusion

Stricter oversight in Indonesia’s P2P lending sector, implemented through OJK Regulation No. 10/POJK.05/2022, aims to address concerns of unethical practices. With 785 Fintech businesses in Indonesia, accounting for 26% of Southeast Asia’s Fintech financing, the country presents lucrative investment prospects. A seminar organized by the Singapore Fintech Association and Enterprise Singapore emphasized the need for collaboration with regional banks and updated regulations to foster financial inclusion. Indonesia’s evolving Fintech landscape highlights the growing influence of P2P lending, solidifying its position as a Fintech hub in the region.

For more insights on the market intelligence, refer to below link:-

Financial technology Market Indonesia

Related Reports By Ken Research:

Philippines Auto Finance Market Outlook to 2027

Global Auto Finance Market Outlook to 2027

MENA Remittance Market Outlook to 2027