Ken Research has recently announced its publication titled, “Life Insurance in Israel, Key Trends and Opportunities to 2019”, which aims at providing in-depth market analysis of Israel’s life insurance segment. It further provides information about growth prospects, distribution channels, top life insurance companies and historic value of review period (2010-14) and projected value of forecast period (2014-19).

The life insurance segment of capital market division manages variety of issues including supervision and regulation of insurance companies and its agents. Looking at the Israel’s life insurance segment, it was the largest segment of Israel’s insurance industry in 2014 having accounted for 51.6% of the Israeli Insurance industry’s gross written premium in 2014. This report aims at providing in-depth market analysis of Israel’s life insurance segment. It further provides information about growth prospects, distribution channels, top life insurance companies and historic value of review period (2010-14) and projected value of forecast period (2014-19)

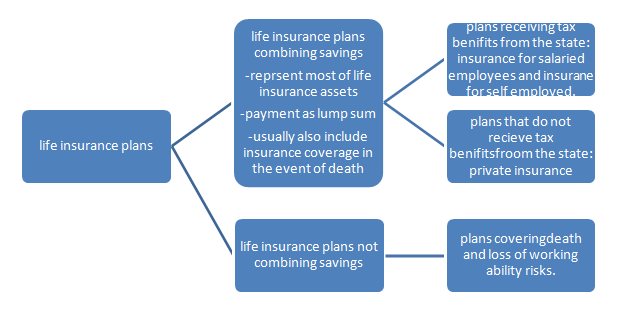

Various categories of life insurance plans in Israel are explained in figure below:

The Israeli life insurance segment is highly consolidated, with the five leading insurers accounting for more than 90% of the segment’s gross written premium in 2014. This high degree of consolidation and low competitiveness in life insurance department of Israel has great impact on insurance rates in Israel. Insurance is dominated by five leading market players i.e. Migdal, Clal, Harel, Phoenix and Menorah-Mivtahim. Further, 11 insurers licensed to conduct life insurance business in Israel.Share of these firms in life insurance segment are given in the table below:

Rising profitability in Israel’s life insurance segment

Fast pace expansion of life insurance business is observed with substantially high profit levels. Remarkable stability and extraordinary profitability has been witnessed in life insurance saving products. These products are associated with low risk and high profitability.

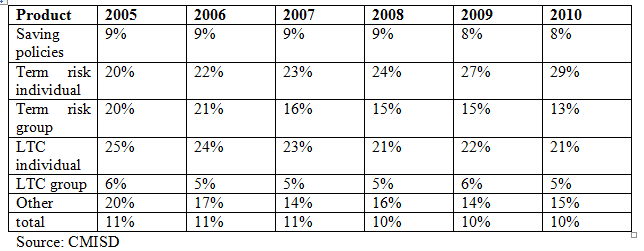

Israel: life insurance commission (in percent of gross premium)

Recent trends also show positive growth of life insurance industry of Israel. Key macroeconomic trends that show modest growth of life insurance sector are:

* According to OECD global insurance statistics, annual real gross premium growth was 2.7% p.a. (2012-13)

* According to OECD global insurance statistics, nominal growth in gross claim payment was 2.2% p.a. (2012-13)

* Gross written premium of Israel’s life insurance segment rose from USD 5.6 Billion IN 2010 to USD 8.6 Billion IN 2014.

* The life insurance segment accounted for 51.6% of Israeli’s insurance industry’s gross written premium in 2014.

* The life insurance segment’s share is expected to increase from 51.6% in 2014 to 55.3% in 2019.

Key Macroeconomic Trends Driving Growth of Card Industry in Denmark

Life insurance industry is projected to grow further in Israel but however growth is expected to be continue at a slower pace than before.

Some macroeconomic factors driving growth in Israel’s life insurance segment are:

** Rising life expectancy and aged population

Population above 65 years of age is increasing rapidly from 0.84 million in 2010 to 0.90 million in 2014. Further according to the World Bank, Israel has one of the highest life expectancy in the world i.e. 82 years. These factors are leading to increasing awareness about life insurance in the citizens of Israel. Further, citizens are investing more in life insurance policies to comfortably support their old age.

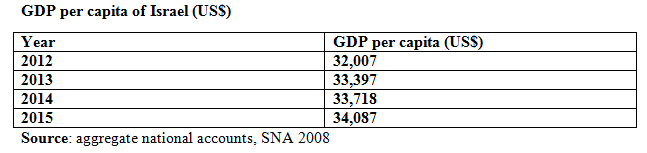

** Strong growth of GDP contributing to growth of life insurance market

Israel has shown stupendous economic growth and has shown better growth than other OECD nations in last 5 years. Nominal GDP and per capita GDP are both increasing significantly.

This strengthening of GDP of Israel is playing a pivotal role in rising demand for life insurance products in economy driving growth of life insurance sector of Israel.

** Strong agency network

Strong agency network, customer support, strong advertising campaigns are also creating awareness amongst people which is also a factor contributing to fast pace expansion of insurance market in Israel.

** Recent pension reforms

Individuals who started saving after January 1995 period can switch these savings to insurance policies and provident funds without any tax deductions or fine payment. This also aided in improvement of insurance industry of Israel.

To know more on coverage, click on the link

Related Reports

The Insurance Industry in Uzbekistan, Key Trends and Opportunities to 2020

Reinsurance in Turkey, Key Trends and Opportunities to 2020

Contact:

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-124-4230204