The report titled “Indonesia Agriculture Equipment Market Outlook to 2025 – By Tractors Market (2 Wheeled & 4 Wheeled Tractors; < 40HP, 40-70HP & >70HP Tractors; Combine Harvesters Market (Less than 70HP, 70HP and >70HP); Rice Transplanters Market; Implements Market (Rotavator, Plough, Harrow, Fertilizer Spreaders & Others); and Regional Demand of Agriculture Equipment (Java, Sulawesi, Sumatra, Kalimantan & Others)” provides a comprehensive analysis on the performance of the agriculture equipment industry in Indonesia. The report covers various aspects including sales value, volume, trends & developments, issues & challenges faced by the industry, competition landscape, financing players, and others. It also covers the country overview, regulatory framework, agricultural overview of Indonesia, land under cultivation, changes in the cropping patterns, farm holding structure & scale of mechanization. Indonesia agriculture equipment market report concludes with the projections for the future of industry including forecasted sales value and volume; future projections by product type and regional demand by the year ending 2025, COVID-19 impact, and analysts’ take on the future.

Indonesia Agriculture Equipment Market Overview and Size:

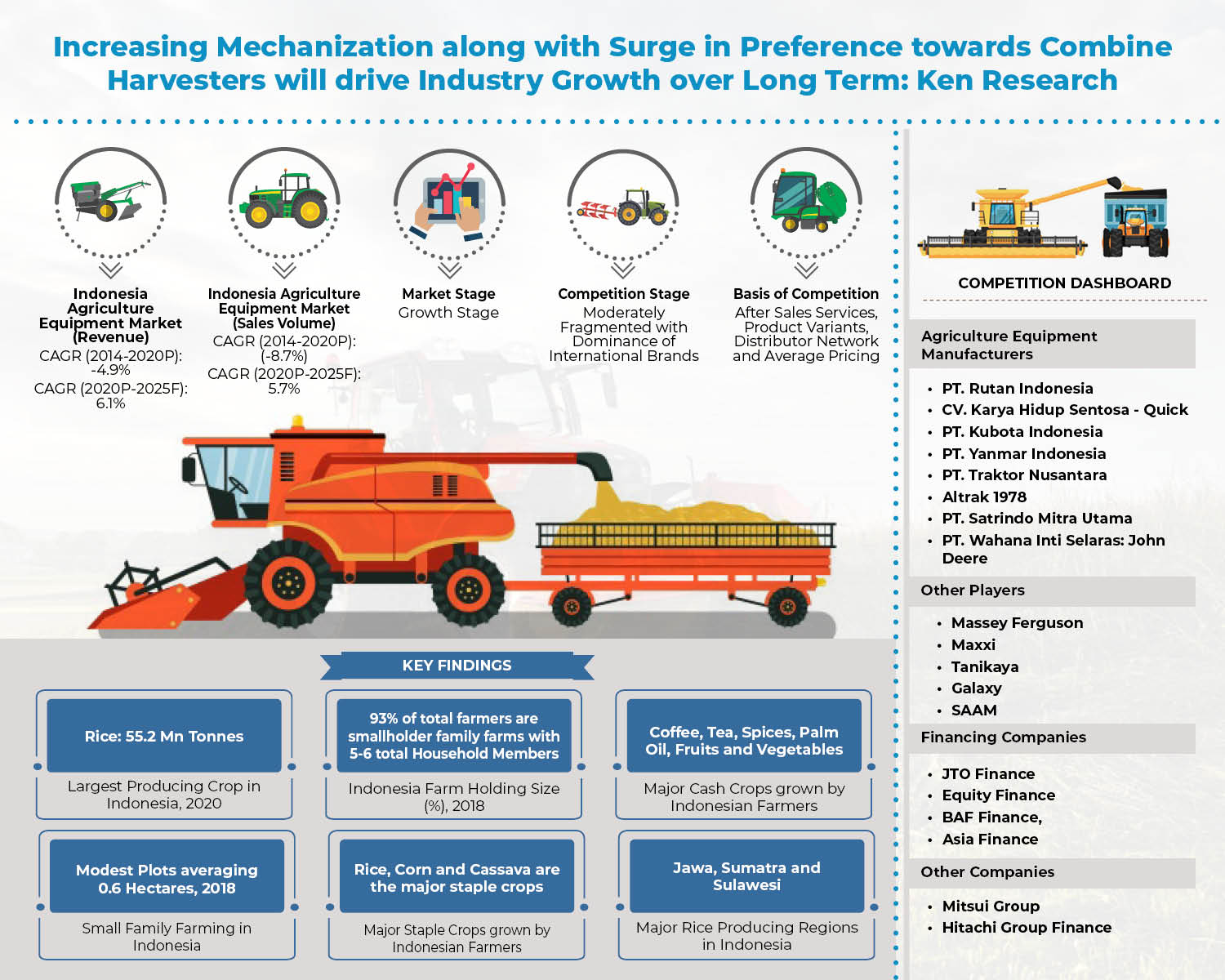

The revenues from the overall agriculture equipment market decreased at a single-digit CAGR of (-8.7%) during the review period 2014-2020. The contribution of the tractor market to the overall market stood at more than 50.0% in terms of revenue and more than 90% in terms of sales volume during 2020. Combine Harvesters have been the second-largest category, to the overall revenues of the agriculture equipment market largely owing to their benefit to speed up harvesting time.

Indonesia Agriculture Equipment Market Segmentation

Indonesia Tractors Market: Tractors Sales Volume and Revenue took a fall during 2014-2020 outlook periods at a negative CAGR of 6.8% and 4.6% respectively due to small landholding size, poor access to credit & financial institutions & deteriorating resource base which are collectively obstructing the growth of tractors. 4W Tractors have been segmented based on power out of which less than 40HP were the most preferred in Indonesia. On the other hand, 2W tractors have gaining traction due to a surge in the total number of farm households & agricultural cooperatives.

Indonesia Combine Harvesters Market: Combine harvester market value & volume showcased a constant growth pattern along with a positive CAGR of 6.1% each during the 2014-2020 outlook period. Combine harvesters of 70 hp and below accounted for the highest total sales of combined harvesters. Various government reforms including the fertilizer subsidy policy and seed development policy were aimed at aiding the revival of displaced farmers.

Interested to Know More about this Report, Request a Sample Report

Indonesia Rice Transplanters Market: Rice transplanter market value and volume showcased volatile growth patterns during the 2014-2020 outlook period. Rice transplanters are not popular in the retail market as they are capital intensive and require heavy training for operations.

Indonesia Implements Market: Revenue from the implements segment increased at a CAGR of 4.7% during 2014-2020. Demand for tractor implements is complimentary to the sale of 2W & 4W tractors since a majority of farmers procure implements along with tractors. Rotavator and plows are the most preferred and demanded tractor implement as they help in seedbed preparation and plowing of land.

By Regional Demand (Jawa, Sulawesi, Kalimantan, Sumatra, and Others): Java region dominated the tractors and rice transplanter product segment during 2020. However, the Sulawesi region took lead for combined harvesters in terms of sales volume during the year 2020.

Comparative Landscape of Indonesia Agriculture Equipment Market

Competition within the Indonesia agriculture equipment market was observed to be moderately fragmented with the dominance of international brands such as Yanmar, Kubota, and other local manufacturers. Quick dominated the 2W tractor segment and Kubota took lead in terms of sales volume for the 4W tractor segment during 2020. For combine harvesters’ segment, Yanmar and Kubota collectively dominated with over 70% sales volume during 2020 in Indonesia. PT Yanmar also showcased dominance towards the rice transplanter segment in 2020. These companies compete based on parameters such as price, products offered, number of tractor variants, distribution network, and after-sales service.

Indonesia Agriculture Equipment Market Future Outlook and Projections

The mechanization rate for land preparation is higher in Indonesia and it is forecasted to get mechanized further as the farmers are likely to increase the usage of disc plow on the farms. Also, the Indonesian government plans to boost national production of local agricultural machinery & has prepared a budget worth $538 Mn for machinery development.

- By Product Segment – Combine harvesters are mainly demanded by a limited target audience and farmers and agricultural cooperatives and this trend is also expected to continue shortly. Manufacturers have invested in Research and Development to minimize post-harvest loss and reduction in grain damage during harvesting.

- By Regional Demand – Java region will continue to be the area with the highest demand & sales of hand tractors in the country. Demand for 4W tractors will continue to arise from Sumatra and Kalimantan regions in the future, due to the above-average farm holding size in these regions.

Key Segments Covered: –

By Type Of Agriculture Equipment

Tractors

By Two-Wheeled And Four-Wheeled Tractors

By Horse Power (HP)

Less Than 40HP

40HP-70HP

Above 70HP

By Regional Demand

Jawa

Sulawesi

Sumatra

Kalimantan

Others (Includes Remaining Regions of Indonesia Such as Bali, Papua, And Rest)

Combine Harvesters

By Horse Power (HP)

Less Than 70HP and 70HP

Above 70HP

By Regional Demand

Sulawesi

Jawa

Sumatra

Kalimantan

Others (Includes Remaining Regions of Indonesia Such as Bali, Papua, And Rest)

Rice Transplanters

By Regional Demand

Jawa

Sulawesi

Kalimantan

Sumatra

Others (Includes Remaining Regions of Indonesia Such As Bali, Papua, And Rest)

Implements

By Implement Type

Rotavator

Plough

Harrow

Fertilizer Spreads

Others (Dozers, Front Loader, Hay Balers and Sprayers)

Agriculture Equipment Manufacturers Covered

- Rutan Indonesia

- Karya Hidup Sentosa – Quick

- Kubota Indonesia

- Yanmar Indonesia

- Traktor Nusantara

Altrak 1978

- Satrindo Mitra Utama

- Wahana Inti Selaras: John Deere

Other Players (Massey Ferguson, Maxxi, Tanikaya, Galaxy And SAAM)

Financing Companies Covered

JTO Finance

Equity Finance

BAF Finance,

Asia Finance

Other Companies (Mitsui Group And Hitachi Group Finance)

Key Target Audience

Agriculture Equipment Manufacturing Companies

Industry Associations

Regulatory Bodies

Financing Companies

Agriculture Equipment Distributors & Authorized Dealerships

Time Period Captured In The Report: –

Historical Period – 2014-2020

Forecast Period – 2020-2025

Key Topics Covered In The Report: –

Executive Summary

Country Overview

Agriculture Overview / Scenario In Indonesia

Cropland Planting Trends In Indonesia, 2015-2019

How do Farmers operate In Indonesia?

Supply Side Of Indonesia Agriculture Machinery Market

Indonesia Agriculture Equipment Market

Indonesia Tractors Market, 2014-2025

Indonesia Combine Harvesters Market, 2014-2025

Indonesia Rice Transplanters Market, 2014-2025

Indonesia Implements Market, 2014-2025

Snapshot On Rental Agriculture Equipment Business In Indonesia

Snapshot On Second Hand Machinery Market In Indonesia

Financing For Agriculture Machinery In Indonesia

Comparative Landscape In Indonesia Agriculture Machinery Market

Indonesia Agriculture Equipment Product Analysis

Indonesia Agri. Equip. Market Future Outlook & Projections, 2020-2025

Analyst Recommendations

For More Information n the research report, click on the below link: –

Future of Indonesia Agriculture Equipment Market

Related Reports by Ken Research: –

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@Kenresearch.Com

+91-9015378249