The report titled “India Used Two Wheeler Market Outlook to 2025- Driven by Increase in Workforce Migration and Aversion towards Using Public Transportation” provides a comprehensive analysis of pre-owned two-wheelers services in India. The report focuses on sales volume, industry revenue, segmentation by unorganized and organized sector, by C2C and B2C distribution channel, by stock piece and customized two wheelers, by source of manufacturing of two wheelers (domestically manufactured and imported bikes), by type of two wheelers (motorcycles and scooters), by engine capacity of two wheelers (100-110cc, 125-135cc, 150-200cc, and others), by average ownership of two wheelers (3-4 years, 4-5 years, 5-6 years and others), by manufacturer of two wheelers (Hero, Bajaj, Honda and others), by body type of two-wheelers (commuter, scooter, sports and others), by certification of two-wheelers (non-certified and certified) and by the financing of two-wheelers (non-financed and financed). The report also covers the overall competitive landscape; government role and regulations, growth restraints, drivers, trends and developments. The report concludes with market projections for future for the market described above highlighting the major opportunities and challenges.

India Used Two Wheeler Market Overview and Size

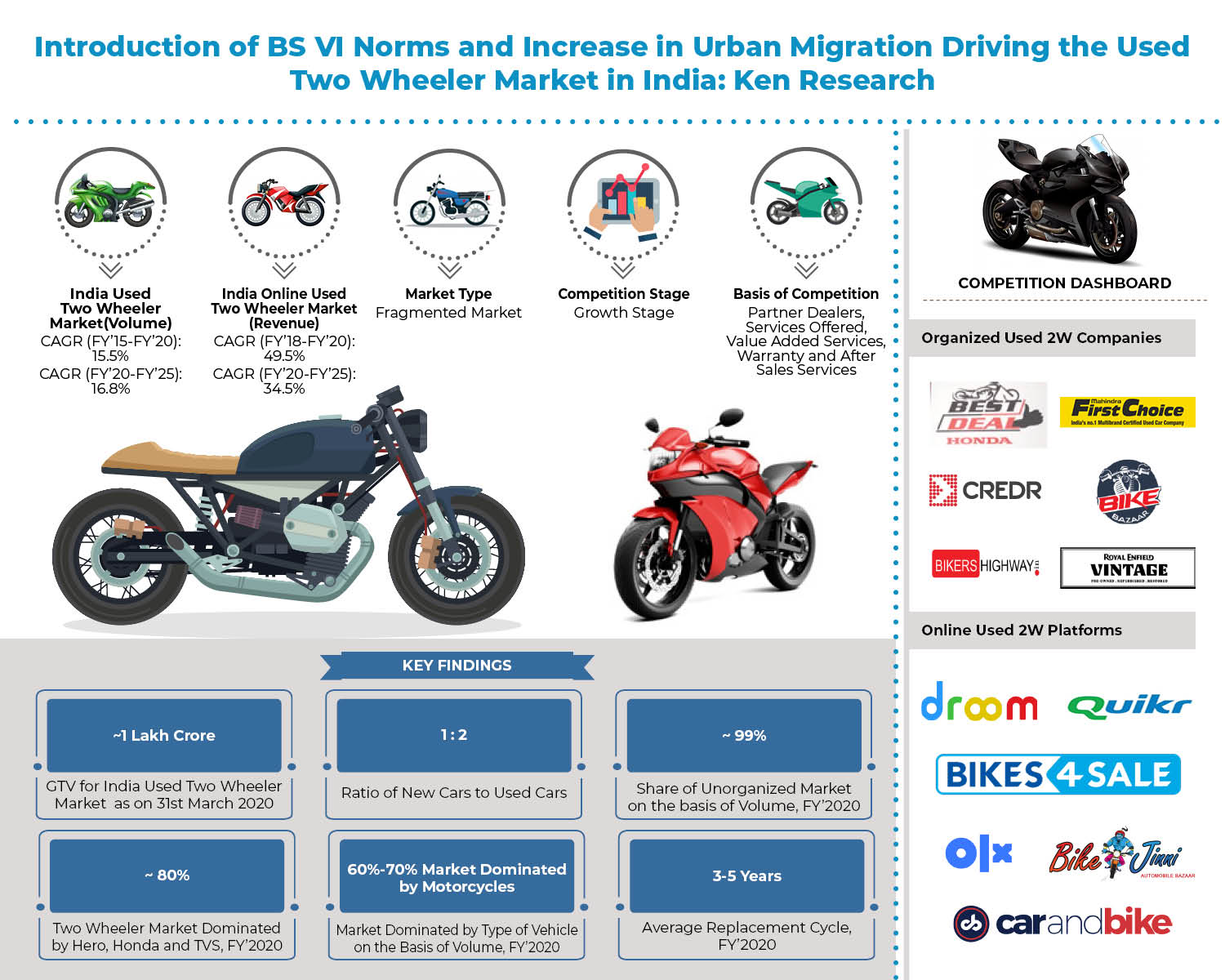

India is the largest producer and manufacturer of two wheelers in the world followed by the Republic of China. Rising fuel prices is one of the primary growth drivers for two-wheelers due to their higher fuel efficiency. In India, commuters across all age groups use motorized vehicles, especially two wheelers owing to the escalating population and rapid increase in traffic congestion, thereby making two wheelers as the most appropriate and convenient mode of transportation in urban areas. The market has attained speedy growth over the period of five years from FY’2015 to FY’2020. The demand for used two wheelers has seen a constant rise over the past few years, especially from models like Honda Activa, Aviator, TVS Jupiter, Bajaj Pulsar and Discover. Even in terms of exports, two-wheelers produced in India are the proud products of the “Make-in-India” initiative where nearly 7 in 10 automobiles delivered out of India are two-wheelers

Interested to Know More about this Report, Request a Sample Report

India Used Two Wheeler Market Segmentation

By Market Structure

In FY’2020 the sales volume through the unorganized sector is generated through individual sellers, local dealers/mechanics and small dealerships which collectively contributed to a majority of the proportion in the overall used two wheelers market.

By Distribution Channel

Due to low awareness regarding the existence of organized online and offline players, the majority of transactions conducted in the market are through C2C or offline B2C channel. The C2C channel controlled a major proportion of the total sales volume in the used two-wheeler market during the FY’2020.

By Type of Two Wheelers

India used two wheelers market was continuously dominated by motorcycles with a massive volume share during FY’2020. This is because male riders travelling a longer distance still prefer motorbikes instead of a scooter due to larger engine and greater mileage offered by motorcycles. On the other hand, gearless scooters are trending in the country, especially among female population.

By Engine Capacity

On the basis of engine capacity of two-wheelers, it has been observed that used bikes with 100-110 cc engine capacity have been mostly purchased by buyers. On the other hand, engine capacities with 125-135 cc, 150-200 cc and others have been gaining traction in India.

By Average Ownership Period of Used Two Wheelers

The buying behavior of Indians has witnessed changes over the review period majorly due to a reduction in the ownership period of two wheelers by the owners. It has been observed that presently, Indians mostly use a two-wheeler for at least a period of three to five years before disposing it off.

By Manufacturer of Two Wheelers

The Indian used two wheeler market is dominated by Hero which is also the global leader and largest player in the new two-wheeler market. The company caters to a wide consumer base and has segmented its market on the basis of income and age group.

By Body Type of Two Wheelers

The category of commuter bikes such as Hero Splendor, Bajaj Discover, and Honda CB Twister contributed to a dominant volume share of used two-wheelers during the FY’2020. The next popular vehicle category in the used-two wheeler space in India has been scooters.

Snapshot on Online Used Two Wheeler Landscape

The online used two wheeler market has been emerging with the rise in the popularity of e-commerce platforms in the country. Online platforms such as Flipkart, Amazon and Snapdeal have enabled India users to trust online platforms and make high value transactions online using their debit/credit cards and net banking. The growth of online advertising, which has fuelled the rise of online classified platforms such as Droom, OLX, Quikr and others have revolutionized the way in which pre-owned vehicles have been sold in the country. With the growth in the number of vehicles sold online, these players not only witnessed a sharp growth in marketplace revenue but also from other sources including advertisements, subscriptions and other value added services. The Overall Online Market is expected to Increase at a double Digit Positive CAGR during the period FY’2020-FY’2025

Comparative Landscape in India Used Two Wheeler Market

India used two wheelers market competition structure was observed to be highly fragmented with the presence of large number of local dealers, small mechanics and individual sellers. Organized players such as Droom, Honda Best Deal, CredR, BikeDekho.com, Mahindra First Choice Wheels Limited (MFCWL) and others contribute very limited to the overall market. Certification and authentication, brand, price, mileage and performance, engine quality/power and total number of dealers are some of the critical parameters on the basis of which companies compete in the organized segment.

India Used Two Wheeler Market Future Outlook and Projections

India Used Two Wheeler Market is expected to grow in the coming years as used vehicles are much cheaper to purchase than a new one, since the introduction of BS VI Standards. Individuals mostly in smaller cities and towns who wish to own a vehicle begin with buying a second hand two-wheeler to get hold of it. Similar is the case of women drivers who prefer purchasing a pre-owned vehicle to learn driving before they actually purchase a new vehicle. Also, local dealers who have been facing tough competition from the online classifieds will be seen associating with the online players to reach out to greater audiences.

Key Segments Covered in India Used Two Wheeler Market, FY’2020: –

By Type of Market

Organized

Unorganized

By Sales Channel

C2C Channel

B2C Channel

By Source

Domestic

Imports

By Modification

Stock Piece

Customized

By Type of Bike

Motorcycles

Scooters

By Engine Capacity

100CC-110CC

125CC-135CC

150CC-200CC

By Replacement Cycle

2 years-4 years

3 years-5 years

5 years – 6 years

By Certification

Certified

Non Certified

By Financing

Financed

Non Financed

Key Target Audience

Two Wheeler OEM’s

Two Wheeler Dealers

Online Portals (Aggregators/Marketplace Platform)

Online Classified Platforms

E-Commerce & Hyperlocal Companies

Private Equity Investors

Time Period Captured in the Report:

Historical Period: FY’2015-FY’2020

Forecast Period: FY’2021–FY’2025

Companies Covered:

Organized Used 2W Companies

Honda Best Deal

CredR

Mahindra First Choice

Bike Bazaar

Bikers Highway

Royal Enfield Vintage

Online Used 2W Platforms

Droom

Quikr

Olx

Bikes4Sale

CarandBike

Bike Jinni

Key Topics Covered in the Report: –

Market size of India used two wheeler markets

Market size of India online used two wheeler markets

Value chain in India used two wheeler markets

Market segmentation of India used two wheeler markets on the basis of market structure, stock piece & customized vehicle, distribution channels, source of

Manufacturing, type of two-wheeler, engine capacity, average ownership period, by manufacturer, body type, certification and financed & non-financed vehicle

Trends and Developments in India used two-wheeler market

Growth Drivers and Restraints in India used the two-wheeler market

SWOT analysis in India used two-wheeler market

Pre-Requisites to Enter the India used two wheeler market

Government Regulations in India used two wheeler market

Major players and their business models

Customer Profile in India used two-wheeler market

Analyst Recommendations

For More Info on the Research Report, Click on the Below Link: –

India Used Two Wheeler Market Growth

Related Reports by Ken Research: –

Contact Us: –

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249