Few Diverse Global Players Dominate the Market Holding Majority Revenue Share Despite the Presence of ~250 Competitors Comprising a Large Number of Country-Niche Players and Some Specialist Players, finds a recent market study on Global Ethernet Controller Market by Ken Research

An ethernet controller is a networking device that allows data communication in a network. Ethernet is among the widely used data transfer and communication technology in data centers, cloud computing, gaming, and personal computing. Due to the stable data transfer and communication in ethernet technology, it has seen wide adoption in servers and embedded systems. Moreover, as the trend of OTT is increasing, the demand for seamless file or video streaming is taking place, which in turn is fueling the growth of high-end ethernet controllers. Products such as telephones, automobiles, and other home appliances use microcontrollers for control purposes. As the requirements for microcontroller increases, the Ethernet controllers utilized in these microcontrollers also are experiencing growing demand.

Ken Research shares 3 key insights on the competitive landscape of this market from its latest research study.

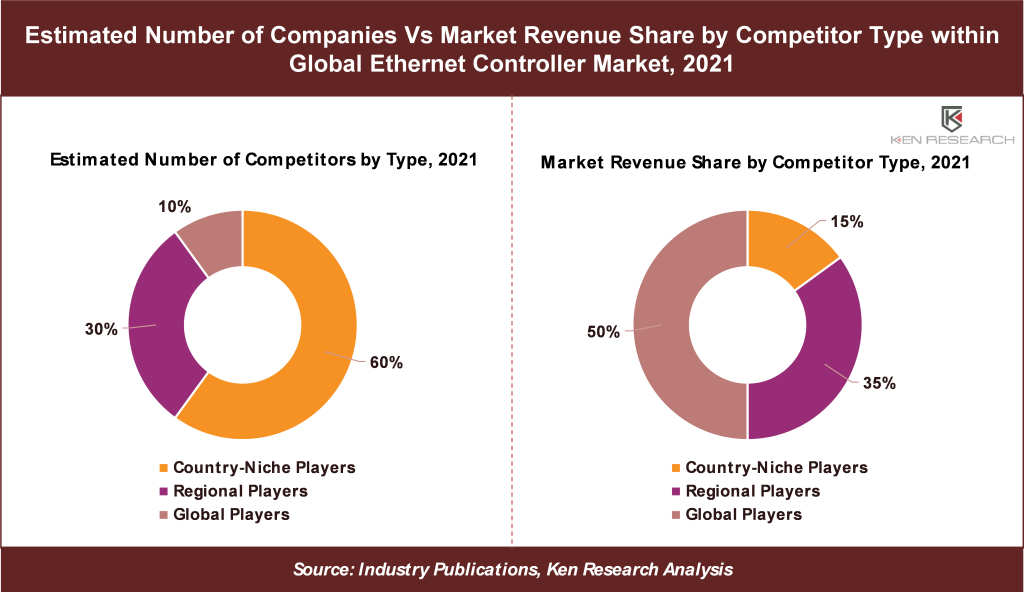

- Global Players Constitute 10% of the Total Number of Competitors While Regional Companies Represent 30% Total Number of Competitors

A comprehensive competitive analysis conducted during The Research Study found that the Global Ethernet Controller Market is highly competitive with ~250 players which include globally diversified players, and regional players as well as a large number of country-niche players having their niche in the ethernet controller space. Most of the country-niche players operate in providing access control solutions to small and medium enterprises in developing countries, especially in India, China, the Philippines, Vietnam, and other South Asian countries.

Intel Corporation, Broadcom Inc., and Silicon Laboratories are among the leading players in the Ethernet Controller Market globally. The large global players comprise about ~10% in terms of the number of companies and ~50% of the market revenue share while the Country Niche players account for ~60% of the total number of companies and ~15% of the market revenue share.

- Leading Global Players Focus on Extensive R&D and Product Development to Cater to a Wider End-user Audience

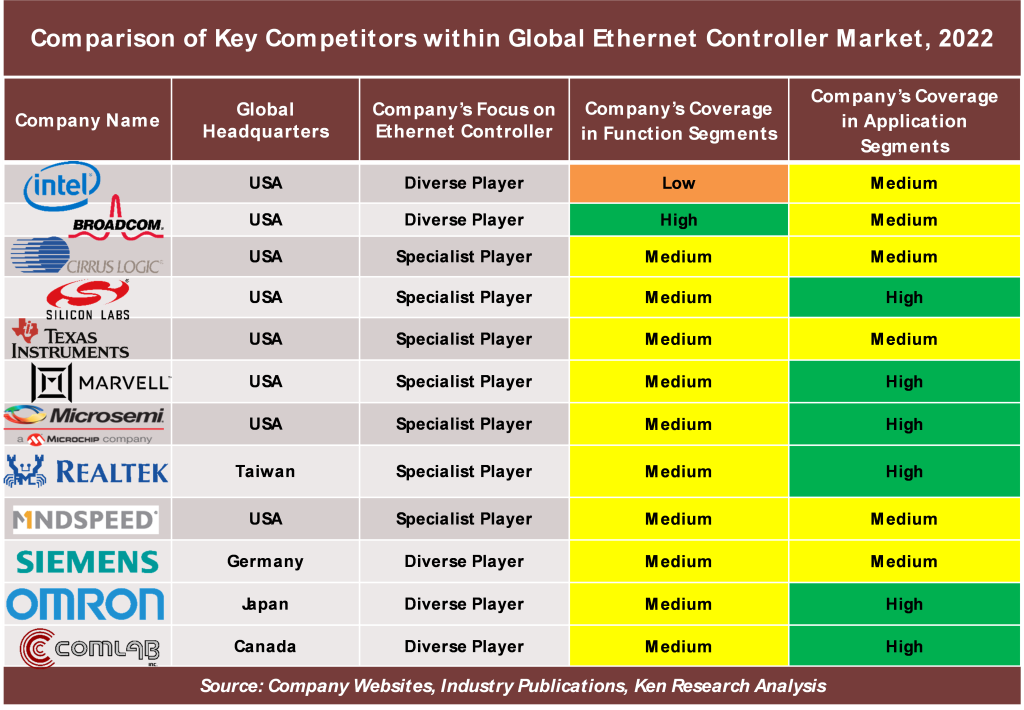

Detailed comparative analysis of key competitors available within The Research Study shows that specialist players such as Silicon Labs, Texas Instruments, Realtek, and others are highly focused on providing specialized solutions regarding ethernet controllers and possess advanced techniques that can be used across multiple industry verticals. Furthermore, several companies and organizations are aggressively investing in R&D and collaborating with big players to increase the development of ethernet controller applications. Some of the developments of the global players are:-

Request for Sample report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDA4

- In November 2021, Broadcom strengthened its commitment to the open compute project by demonstrating a leading-edge and broad range of initiatives at the 2021 Open Compute Project (OCP) Global Summit. Broadcom Ethernet switch and routing chips, Ethernet network adapters, PCIe switches, PAM4 Line card PHYs, and SAS/SATA/NVMe storage solutions were featured in a wide range of OCP designs at the summit.

- In 2020, OMRON Joined the “Nokia Local 5G Technology Partnership” – To Accelerate the Development of 5G Solutions for Manufacturing Businesses and Promote Industry 4.0.

- The COVID-19 Pandemic Limited the Growth by Affecting the Manufacturing Plants’ Operations

The initial spread of the virus led to the shutting down of the controller component manufacturing plants. Reduction in output led to a global shortage of components as demand increased as opposed to estimates made initially by component makers.

In May 2020, Players like Cisco, Juniper, and many others in the 400 Gbe ecosystem were planning to demonstrate the interoperability and growing volume of 400gbE products at the fiber Optic communication Exhibition & Conference 2020 along with some of the major suppliers of the networks operating in 400GbE of 400G implementation grade, but the players decided to start manufacturing in the first half of 2021, as production had stopped due to the pandemic.

At the start of the second quarter of 2020, the ethernet controller market dipped down by nearly 2% for the next three quarters. However, by mid-2021, the covid restriction for travel was lifted which resulted in an optimistic growth rate during the entire year. The market then started to quickly grasp the pace and is currently expected to showcase a CAGR of ~7% for the duration (of 2022-2028).

Governments Initiatives to Promote the Adoption of Ethernet Controller Technology in Major Regions Is Helping the Market Grow

- In March 2019, the European Commission declared a new rule to make Intelligent Speed Assistance (ISA) obligatory for all recently manufactured light vehicles starting in 2022. Euro NCAP and the US NHTSA safety assessment are further driving forces behind ADAS embracement which include the accessibility and the performance of safety assistant systems in their situations.

- In March 2021, Advanced Television Systems Committee (ATSC) and Telecommunications Standards Development Society, India (TSDSI) signed a deal to boost the embracement of ATSC norms in India to make broadcast services available on the mobile bias. This allows the TSDSI to follow ATSC norms, fostering global digital broadcasting standard adjustment.

- In April 2021, the government directed out that companies similar to Ericsson and Nokia are now eager to expand their operations in India, and global companies like Samsung, Cisco, Ciena, and Foxconn have expressed interest to set up their manufacturing base in the country for telecom and networking products.

- In 2021, the Union Cabinet of India approved 12,195 crores (US$1.65 billion) production-linked incentive (PLI) scheme for telecom & networking outputs under the Department of Telecom.

For more information on the research report, refer to the below link:

Global Ethernet Controller Sector 2028: Ken Research

Follow Us

LinkedIn | Instagram | Facebook | Twitter

Contact Us: –

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249